Electric Car Tax Changes – What You Need to Know

The road tax exemption for EVs is ending. Here’s when the changes kick in, what it means for electric drivers, and how it affects leasing.

Electric Car Tax Changes – What’s Happening and When

Electric cars have been tax-free for a while now — one of the big incentives for going electric. But that’s about to change. The government is phasing out road tax (Vehicle Excise Duty, or VED) exemptions for EVs as part of a wider update to how cars are taxed in the UK.

So if you’re thinking about leasing or buying an electric vehicle, here’s what you need to know.

What’s changing?

From April 2025, electric cars will no longer be exempt from road tax. Right now, battery electric vehicles (BEVs) pay £0 in VED. But under the new rules, EVs will start paying the same rates as petrol and diesel cars.

This applies to:

New EVs registered on or after 1 April 2025

EVs first registered between 1 April 2017 and 31 March 2025

So even if you already drive an EV, your tax bill might be about to change.

What will the road tax be for EVs?

Here’s how it’s expected to work:

New EVs (from April 2025 onwards)

Will pay the first year VED rate for petrol cars (currently £180).Existing EVs (registered between April 2017 and March 2025)

Will also start paying the standard annual VED rate from April 2025.Expensive EVs

If your EV originally cost over £40,000, it will also be subject to the expensive car supplement — an extra £390 per year for five years, starting from year two.

These figures might change slightly by 2025, but the structure is now confirmed.

Why are the rules changing?

The government says the move is about making the tax system fairer. As more people switch to electric, VED revenue (which helps pay for road upkeep) has dropped. So this change is about closing the gap as EVs become more common.

Will this affect leasing an electric car?

Yes — but probably not as much as you think.

If you lease a car, the road tax is usually included in your lease deal. That means:

You won’t need to pay it separately

Your monthly payments might increase slightly for EVs registered from April 2025 onwards

It won’t affect you mid-lease if your car was registered before the change kicks in

If you’re leasing before April 2025, you’ll still get the £0 road tax benefit — at least for now.

Are EVs still worth it?

Absolutely. Even with road tax coming in, EVs are still:

Cheaper to run (no petrol, less maintenance)

Lower Benefit-in-Kind (BiK) for company car drivers

Exempt from things like the ULEZ charge

Better for the environment (and often more fun to drive)

And with more models, better ranges, and more charging options, the case for going electric is still strong.

The takeaway

From April 2025, electric cars will start paying road tax — but leasing can still be a smart, simple way to switch to electric without any surprise costs.

If you want to lock in a lease before the tax changes hit, or you’ve got questions about what this means for your next EV, just get in touch with the Motorlet team. We’ll help you find the right deal, and keep everything clear and hassle-free.

What's next?

Enjoyed this? Read our latest news

Hyggemarketing: Reliable Nationwide Travel for a Growing Agency

Jack Vernon, CEO of Hyggemarketing, shares how his VW Caddy lease from Motorlet transformed his travel experience—bringing comfort, professionalism, and room for his beloved Akita, Orla.

John Worth Group: A Seamless Fleet Leasing Experience with Motorlet

John Worth Group, a renowned interiors specialist, partnered with Motorlet to streamline their management vehicle fleet. Over two years, they've experienced professional service, timely deliveries, and competitive pricing, reinforcing their trust in Motorlet's leasing solutions.

Business Lease Success for ECF

Ryan at ECF wanted a specific Audi e-Tron GT with options — and we were the only leasing company that could deliver it, under budget, with expert BIK guidance.

Customer Stories

We've helped over 1,000+ customers find their dream car, hear what they have to say.

Read more reviews“As usual, top class service. The team at Motorlet provided first class service from beginning to end with the friendly helpful expertise of Josh and Wendy. Will continue to use their services as I have done for the past six years...” Keep reading

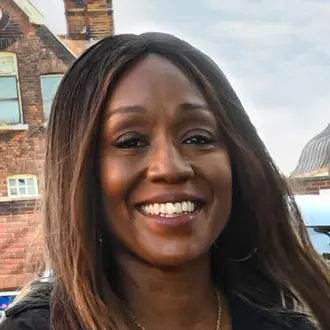

Diane Parish | Audi Q5

New deals weekly

Subscribe to get the latest offers, guides, new, and more, straight to your inbox.